Applications: Exponential functions and logarithms: Applications: Exponential functions and logarithms

Growth rates and compound interest

Growth rates and compound interest

Exponential growth function

An exponential growth function has the function rule \[f(x) = \green{c} \cdot \

\blue{g}^x\]

Here,

- \(\green{c}\) is the initial value, the function value at \(x=0\),

- \(\blue{g}\) is the growth factor or the base,

- \(x\) is the argument of the exponent

A growth that can be described by an exponential growth function, is also called an exponential growth model or simply exponential growth.

The growth factor in this exponential growth model indicates how quickly the function increases or decreases. We will now examine the connection between the growth factor and the growth rate.

Growth rate

The growth rate of exponential growth with function rule \[f(x) = \green{c} \cdot \blue{g}^x\]is equal to \(\blue{g}-1\).

If we multiply the growth rate by \(100\), we get the fixed percentage increase or decrease of the exponential growth model.

Example

Growth factor: #\blue{1.2}#

Growth rate: #0.2#

Percentage increase: #20\%#

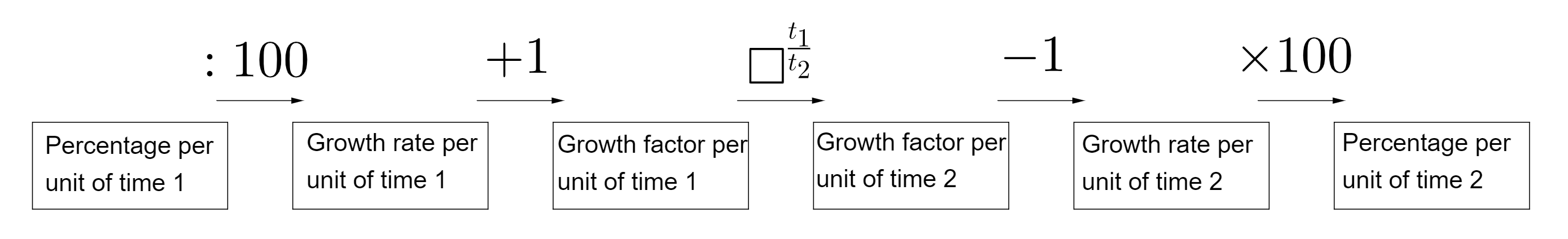

We often want to compare two exponential growth processes with different periods. For example, compare two savings accounts where the first savings account has a monthly interest rate and the second savings account has a yearly interest rate. The following theorem provides a formula to converse the growth factor in one time period to the growth factor in another time period.

Conversion formula for growth factors

Suppose that the growth factor per period #\orange{t_1}# is equal to #\blue{g}_1# and the growth factor per period #\purple{t_2}# is equal to #\blue{g}_2#.

Here, #\orange{t_1}# and #\purple{t_2}# are expressed in the same units of time.

Then \[ \blue{g}_2=\blue{g}_1^{\frac{\purple{t_2}}{\orange{t_1}}}\]

Example

If #\blue{g}_1=1.005# per #\orange{t_1}= \orange{\text{month}}#

then

#\blue{g}_2=1.005^{\frac{\purple{12}}{\orange{1}}}\approx 1.062# per #\purple{t_2}=\purple{\text{year}}#

A special case of the exponential growth function is the formula for the future value without additional deposit. This formula is used when someone deposits an initial capital #S_0# in a bank over a number #n# periods (e.g., years) accruing compound interest at a certain rate per period. The formula gives the future value after the duration #n# if no additional money is deposited (nor withdrawn) in the interim. We describe these results in terms of the growth rate. The growth rate is determined by the interest rate.

Formula for future value without additional deposit

The future value #S(n)# in a compound interest scenario can be calculated with the function rule

\[ S(n)=\green{S_0}\cdot\left(\blue{1+i}\right)^n\]Here,

- #\green{S_0}# is the initial capital,

- #n# is the number of periods,

- #i# is the growth rate per period.

Example

After #5# years an initial capital of #\euro \, \green{5000}# euros with an interest rate of #2\%# is equal to

\[\begin{array}{rcl}S(5)&=&\green{5000} \cdot \left(\blue{1+\frac{2}{100}}\right)^5\\ \\&\approx& \euro \, 5520.40\end{array}\]

Or visit omptest.org if jou are taking an OMPT exam.