Sequences and series: Financial applications of sequences and series

Bullet loan

Bullet loan

The theory on sequences and series provides a good starting point to discuss different types of loans. We will discuss loans that have terms of fixed length for the duration of the loan, where at the end of each term a fixed interest is paid over the remaining debt. The original debt is paid off with installments at the end of each period.

With a bullet loan, which we will discuss below, the installment is zero up to the last term. Two other types of loans, a linear loan and an annuity, are dealt with later. We will start with describing a general pattern.

Loans

When discussing loans we are always assuming a duration of #n# terms of fixed length (for example units like a month or a year), where at the beginning an amount #K# is borrowed, and the entire loan including interest must be paid off at the end of the duration #n#.

The interest is written as #p\%#. In many cases, we use the growth rate #i = \frac{p}{100}# instead of the percentage #p\%#. With all the loans we discuss, the interest over the remaining outstanding debt is paid at the end of a term.

We use the following notation, where #j# indicates a term (hence,#j=1,2,\ldots,n#):

- #a_j# is the installment at the end of the #j#-th term

- #r_j# is the interest payment at the end of the #j#-th term

- #R_j# is the remaining outstanding debt at the end of the #j#-th term

The properties are:

- #R_0=K#

- #R_j = R_{j-1}-a_j#

- #R_n = 0#

- #\sum_{j=1}^na_j =K#

- #r_j = R_{j-1}\cdot i#

If there would not have been an interest payment or payment to pay of the debt at the end of the duration, then the remaining outstanding debt will follow the exponential growth model: #R_j = K\cdot (1+i)^j# for #j\lt n#. This situation is only fitting in the model above if there's only one term #(n=1)#, since we assume that there's an interest payment at the end of each term. In that case #i# is the interest over the entire period and #K-a_1 =R_0-a_1 = R_1=0#, hence, #a_1=K# and #r_1=K\cdot i#.

The formulas indicate that, for a loan with given growth rate #i#, initial amount #K# and duration #n#, all remaining debts #R_j# and all interest payments #r_j# are known once the installments #a_j# are known. The different types of loans depend on this. We will take a closer look at three types of loans:

- Bullet loan: no installments in the terms in between

- Linear loan: constant installment per term

- Annuity: constant sum of installment and interest per term

We will discuss each of these loans separately. Here we take a look at the first, most simple one.

Bullet loan

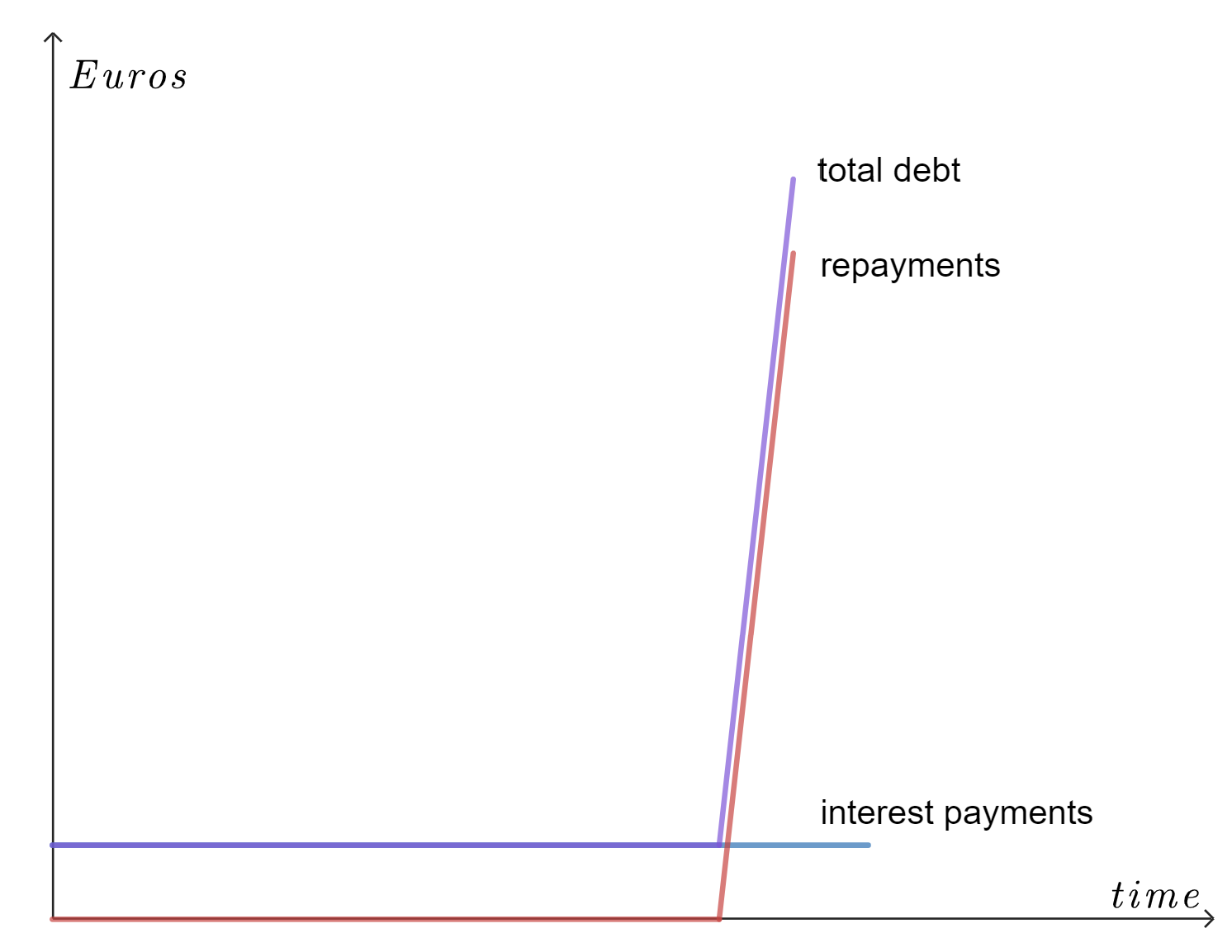

A bullet loan is a loan with no intermediate installments. The interest of #p\%# (or growth rate #i=\frac{p}{100}#) is paid at the end of each term. The initial loan (#K#) is paid back entirely at the end of the duration (#n#).

Hence, a bullet loan is characterized by the following formulas:

\[\begin{array}{rcl}\text{Installments}&&a_1 = a_2 = a_3 =\cdots = a_{n-1} = 0\\ &&a_n = K\\ \text{Interest payments }&& r_1 = r_2 = r_3 =\cdots = r_n = K\cdot i\\ \text{Remaining debt }&&R_1 = R_2 = R_3 =\cdots = R_{n-1} = K\\ &&R_n = 0\end{array}\]

Since there are no intermediate installments, one needs to pay interest on the entire initial loan, during the whole duration.

This type of loan is characterized by relative low payments during the duration and a very high payment at the end of the duration.

Or visit omptest.org if jou are taking an OMPT exam.