Assessing investments: Economic approach

The economic approach

The economic approach

In addition to the accounting approach to assessing the financial attractiveness of an investment, there is also economic approach.

The economic approach

The models of the economic approach differ from their accounting counterparts in that two additional factors are included in the calculations:

- the investor's time preference

- the risk of the investment

These two factors are added together to form the discount rate #r#. The discount rate is used to convert all cash flows from an investment to their present value . This process is also called discounting .

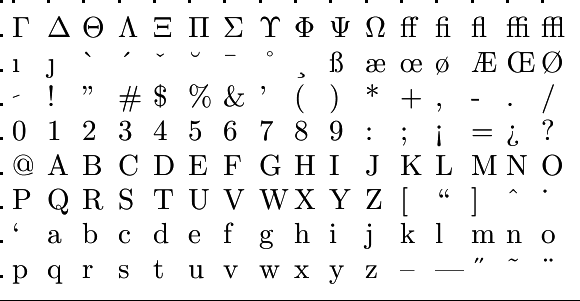

We will give the corresponding formulas.

Discounting

To calculate the present value #PV# of a cash flow, we use the following formula:

\[\begin{array}{rcl}

PV_i & =& \dfrac{C_i}{(1+r)^i}\\

&&\phantom{xx}\color{blue}{\text{the present value of the cash flow in period }i}\\

PV& =& \displaystyle \sum_{i=0}^nPV_i\\

&&\phantom{xx}\color{blue}{\text{the present value of the entire investment}}

\end{array}\]

#C_i# is the value of the cash flow in period #i# and #r# is the discount rate applied.

Or visit omptest.org if jou are taking an OMPT exam.